are union dues tax deductible in ontario

Ontario 01542 effective Feb 1 1989 Prince Edward Island 0128 effective Jan 1 2018. Line 21200 was line 212 before tax year 2019.

How To Claim Union Dues On The Tax Return Filing Taxes

Still not finding the answers you need.

. You can not transfer amount in line 212 to your spouse. Yes your membership fee is tax deductible. Professionals who are required by law to pay dues for professional boards or parity or advisory committees may also deduct those fees.

Union dues are a very small percentage of total earnings. Similar to union dues you are also eligible for tax deductions on certain other items. Steelworkers believe in financial accountability.

The employee then deducted the dues if the employee was able to itemize deductions. Professional dues can not be carried forward. Prior to 2018 an employee who paid union dues prior may have been able to deduct them as unreimbursed employee business expenses if the total of the dues plus certain miscellaneous itemized expenses reached a certain level.

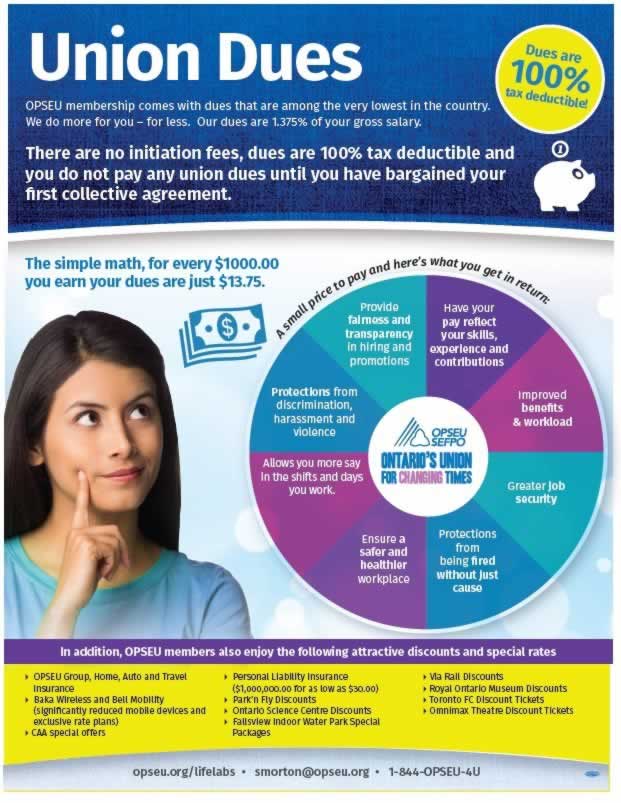

At 15 per cent of total earnings MoveUPs dues are lower than most Canadian unions. The simple math for every 100000 you earn your dues are just 1375. Dues remitted to the PWU Hiring Hall by employers are shown on the members T4 slip provided by the employer for income tax purposes.

Total Deducted Per Month. Union accounts are audited regularly by professionals. In accordance with the relevant collective agreement the employer must deduct an amount equal to the monthly union dues from the pay of any employee in the bargaining unit.

Greater than 2600 but less than 3250. Membership dues for trade unions or public servant associations may be deducted on income tax returns. No employees cant take a union dues deduction on their return.

And because dues are tax deductible it works out to be much less. However the job-related expenses deduction is still available to people. You can deduct any union dues paid by you from your taxable income.

Calgary Airport your union dues are determined the same way with the exception that the most recent 1st step salary of your collective agreement is utilized. ONA Dues Tax Treatment. We do more for you for less.

Portion of Dues for Box 44 on T4 tax deductible Equal or greater than 3250. There are no initiation fees dues are tax deductible and you do not pay any union dues until you have bargained your first collective agreement. Annual dues for membership in a trade union or an association of public servants.

You can print a copy of your tax receipts for this year and the past six years from your record in the Members Area of our website. On their T4-form Statement of Remuneration Payment taxpayers can find how much deduction they are entitled to. For example if you are working 40 hours a week and your weekly earnings are approximately 1000 your weekly dues are 155 per cent of 1000 which works out to be 1555 plus 2 cents per hour worked.

If you are a member of either NEU UNW or YEU the PSAC portion of dues is calculated. Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your employement. Our dues are 1375 of your gross salary.

Do part-time employees pay reduced union dues. You can not claim annual union dues from past year. Dues are 155 per cent of gross wages plus 2 cents per hour worked.

Where do I place that info. Union dues and professional association fees are tax deductible. It may seem counter-intuitive but you should enter your Union Dues in the Federal interview even though it will only benefit you on your state return.

Labor Day 2018 doesnt bring much good news for unions. Dues are tax-deductible and dues are not paid if you are off work due to layoff injury sickness or leave. Taxation of Union Dues.

If you have no income professional dues deduction will not provide you any taxable benefit. Can You Claim License Fees On Taxes. However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017.

And they lost a tax break in last years tax reform bill. Professional board dues required under provincial or territorial law. As the situation around COVID-19 is constantly evolving we are making it a priority to keep our members frequently updated.

There is no maximum limit for union dues. Politicians and the public tend to view them unfavorably. Union dues are not transferable.

The international audit is a public report delivered to all local unions. Only union membership dues are deductible and union members may not deduct initiation fees licenses. Union Dues in California are deductible on CA tax form correct.

Membership in the workplace organizations has at best stalled. Equal or less than 2600. For example if your annual income is 40000 and you paid 1000 as union dues your taxable income will be only 39000.

Portion of Dues for Insurance. The only deductions that union members may deduct are dues to the union and initiation fees licenses and other charges cant be deducted. Therefore union dues may have to be adjusted retroactively.

Reinstatement Fees are not tax deductible. Straight Time Hourly Rate. Union dues no longer deductible under new tax law.

Members will receive a receipt from the PWU in February of each year for Basic Dues paid to the PWU Hiring Hall in the previous calendar year for income tax purposes. If youre self-employed you can deduct union dues as a business expense. Monday September 03 2018.

How To Claim Union Dues On The Tax Return Filing Taxes

Where Do I Enter My Union And Professional Dues

Do I Have To Pay Union Dues In Canada Cubetoronto Com

Are Union Dues Tax Deductible Canada Cubetoronto Com

Union Professional And Other Dues For Medical Residents Md Tax

Different Types Of Payroll Deductions Gusto

How Much Are Union Dues In Ontario Cubetoronto Com

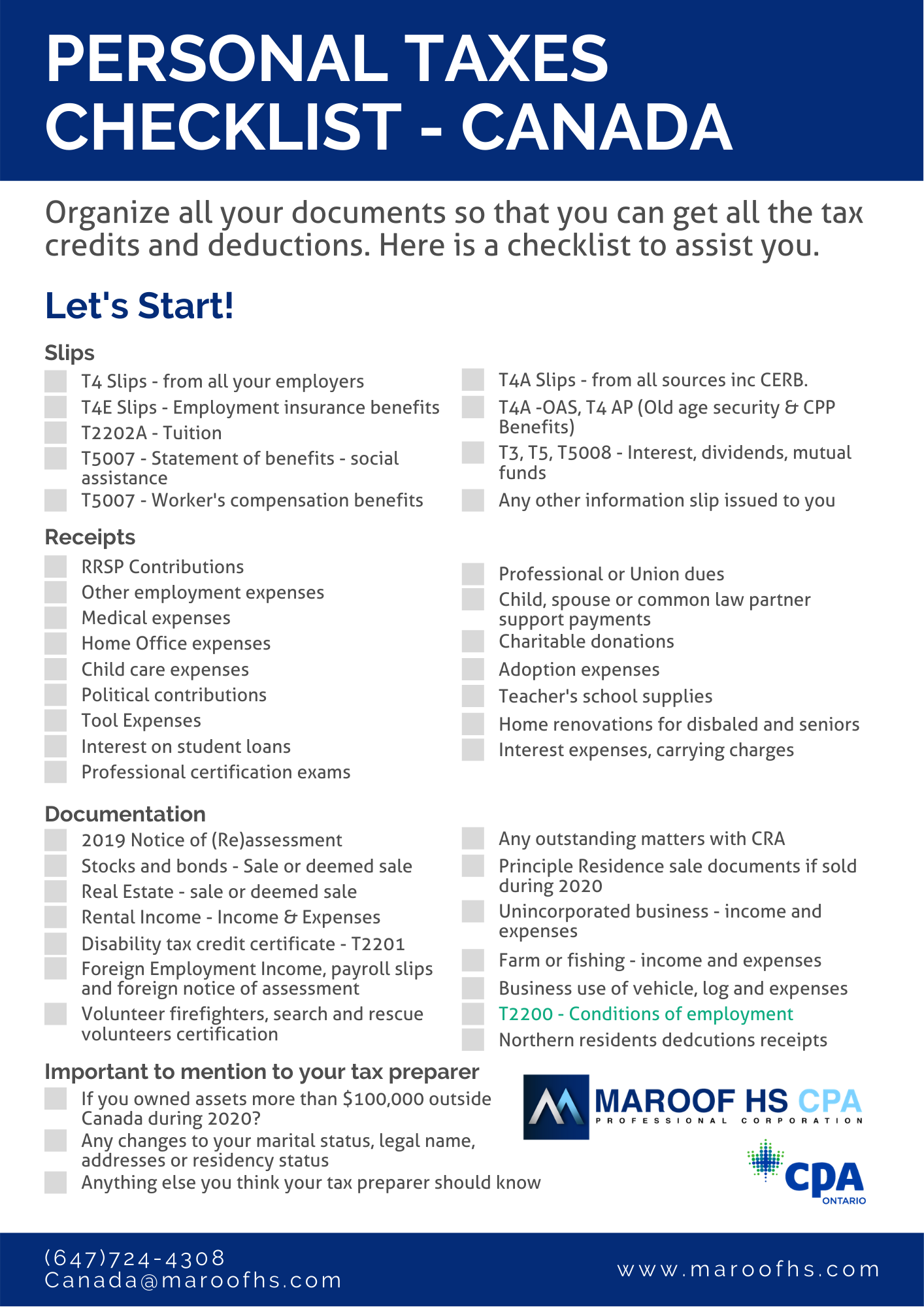

2020 Individual Income Tax Return Checklist Maroof Hs Cpa Professional Corporation Toronto

How To Claim Union Dues On The Tax Return Filing Taxes

Where Do I Enter My Union And Professional Dues

Are Union Dues Tax Deductible Canada Cubetoronto Com

Safety Tracking Spreadsheet Business Worksheet Spreadsheet Business Business Tax Deductions

Where Do I Enter My Union And Professional Dues H R Block Canada